non filing of income tax return penalty

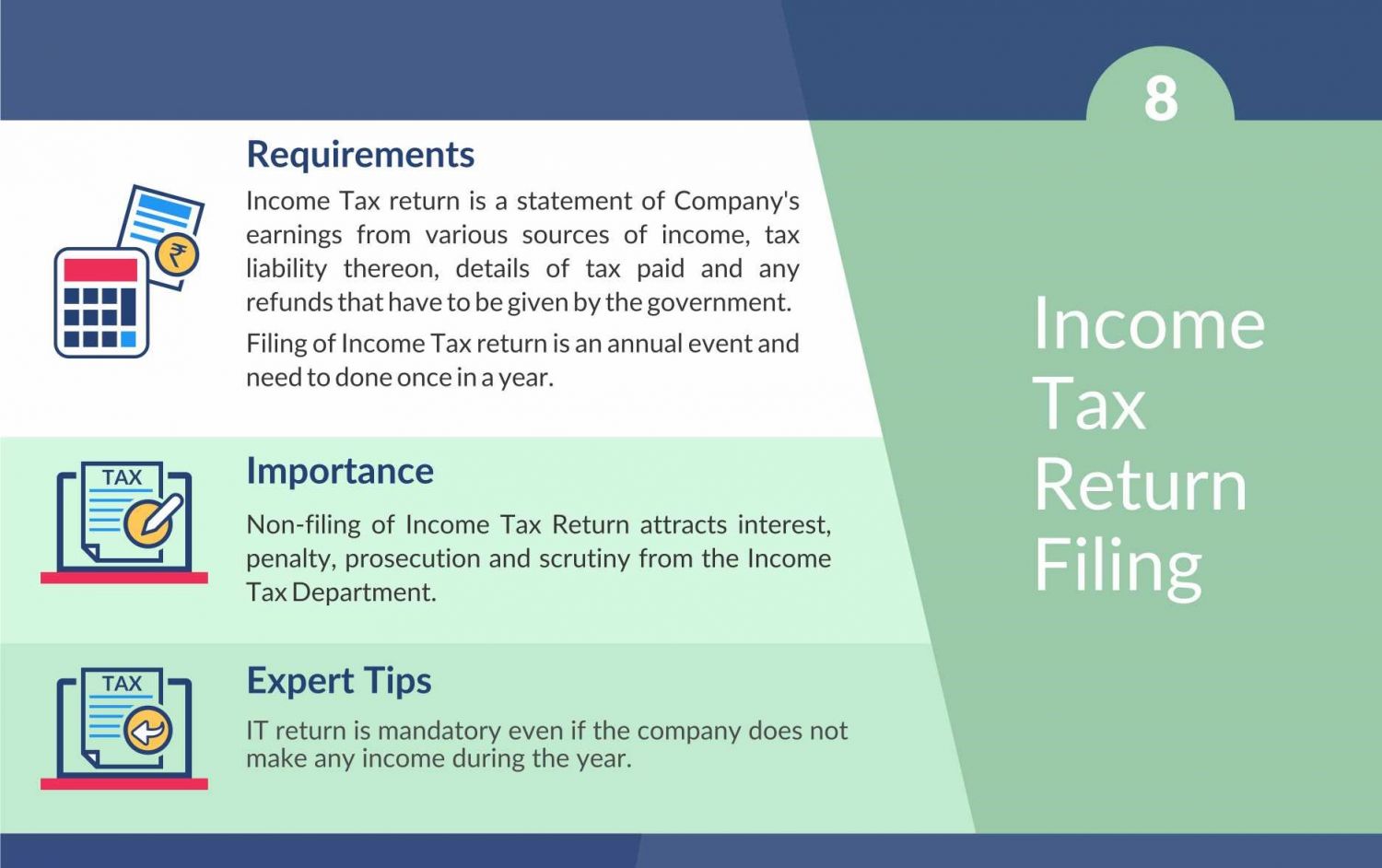

The penalty for not filing taxes is also known as the failure-to-file penalty or the late-filing penalty. Section 276C provides for punishment in the case of wilful attempt to evade tax penalty or interest or under-reporting of income.

Late Filing Or Late Payment Penalties Missed Deadline 2022

2 Interest under Section 234A of Income Tax Act 1961.

. As per section 276C if a person wilfully. However if under-reported income is in. The penalty for non-payment of money owed when you file your tax return is 05 percent per month starting with the month you return is due.

A penalty of Rs1000 each day of default has been implemented from Saturday after the expiry of return filing date on October 15 2021. Youll get a penalty if you need to send a tax return and you miss the deadline for submitting it or paying your bill. A new amendment has been made.

Penalties leviable under the Income-tax Act. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. 2If undisclosed income not admitted during search but disclosed in the return of income and taxes is paid.

4 Best judgment assessment. The maximum overall failure to file penalty is 25 of your unpaid tax. 270A 1 Under-reporting and misreporting of income.

After your return is five months late you will reach this maximum penalty threshold. The penalty is usually 5 of the tax owed for each month or part of a month the return. Section 1821 of Income Tax Ordinance 2001 has prescribed offences and penalties for failure in filing income tax return and wealth statement.

The IRS charges a penalty for various reasons including if you dont. Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022. First theres the late-payment penalty which equals 05 of your unpaid tax bill for each month or partial month you owe that money up to a total of 25.

Penalty for default in making payment of Self Assessment Tax As per section 140A1 any tax due after allowing credit for TDS advance. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less. If you owe taxes and fail to pay them you.

File your tax return on time. Important IRS penalty relief update from August 26 2022. There is also a minimum penalty.

A new penal regime for non-filing of income tax return has been introduced through amendment in section 182 of the Ordinance. Taxpayers who dont meet their tax obligations may owe a penalty. It impacts the carry forward and set off of losses and time for.

Theres also the failure. 3 Non-Carry Forward of Losses. Here is a list of the categories of taxpayers and their penalties for not filing income tax returns within the due date.

PENALTIES FOR LATE FILING OF TAX RETURNS. Here 3 categories of individuals are considered. 1 Penalty under Section 271F of Income Tax Act 1961.

If undisclosed income admitted during search 10 as penalty. ITR Late Filing Penalty - Filing your tax returns after the due dates has more consequences than just penalty. This penalty for non-payment can.

Youll pay a late filing penalty of 100 if your tax return is up to 3. A person who fails to file return within. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties.

The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic. A sum equal to 50 of the amount of tax payable on under-reported income. The failure-to-file penalty grows every month at a set rate.

Penalty U S 234f Fees For Late Filling Of Itr

What Happens If Itr Is Not Filed What Are The Consequences

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

Irs To Refund 1 6 Million People Who Missed Tax Filing Deadlines During The Pandemic Cbs News

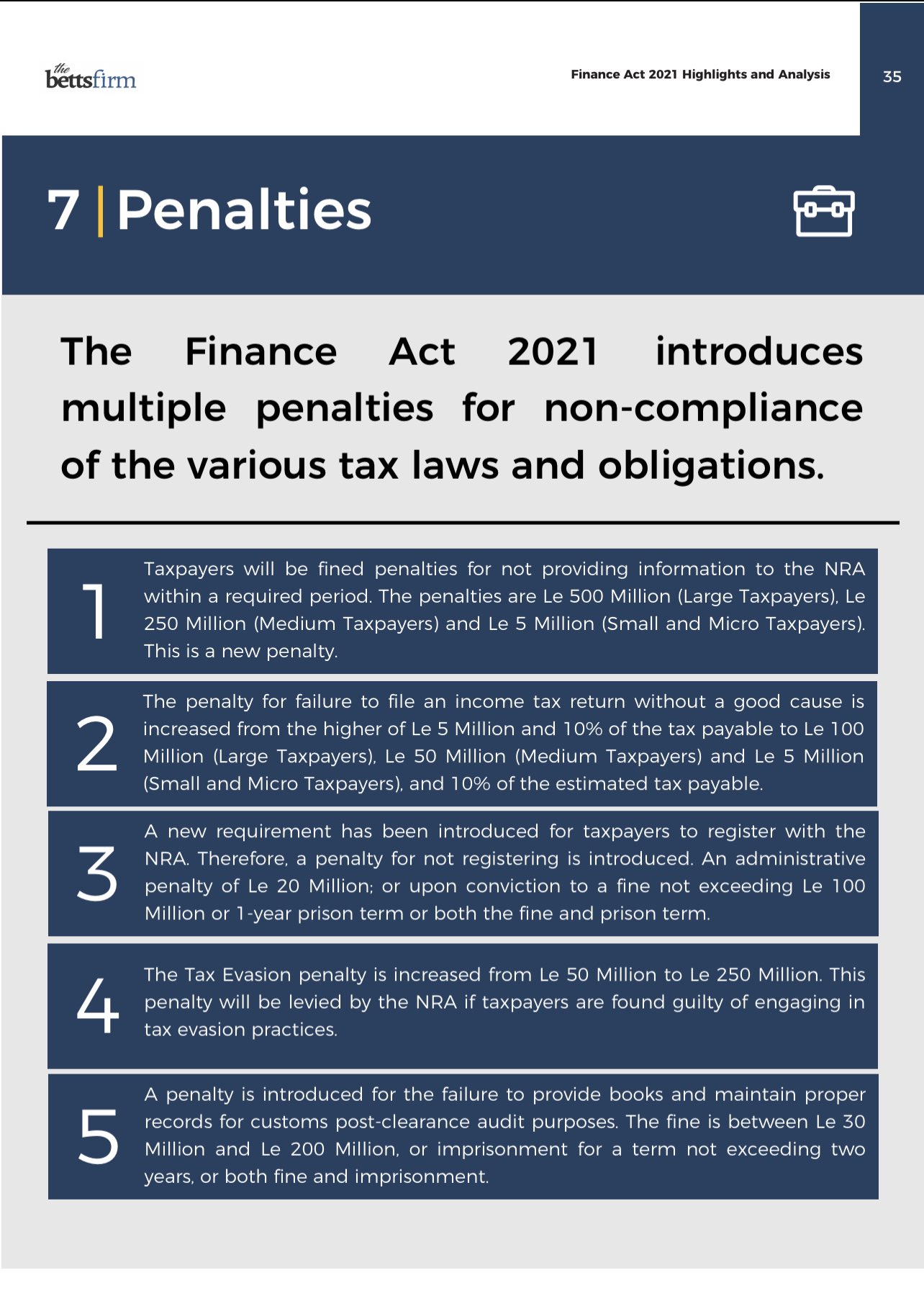

Penalty For Non Filing Of Annual Income Tax Returns 2021 Budget

Tbf On Twitter New Penalties Are Introduced Including A Penalty For Not Registering With Nrasierraleone Penalties For Failure To Provide Information Increase In Non Filing Penalty For Income Tax Returns And Increase In

Irs Late Filling And Late Payment Explained Experts In Quickbooks Consulting Quickbooks Training By Accountants

What Are The Tax Penalties For Not Filing Tax Returns

Individuals Unable To Pay Balance Due On 2017 Tax Returns Should Still File

Penalty For Failure To File Corporate Tax Return

Itr Filing 2021 22 Know Last Date To File Income Tax Returns Penalty On Missing Deadline And Process

The Penalty For Filing Taxes Late Past Due Even If You Owe Nothing

Penalties For Filing Your Tax Return Late Kiplinger

5 Things That Will Happen If You Do Not File Income Tax Return Itr By August 31 Shah Doshi Chartered Accountants

Systemic Penalty Relief Is Now Available For Certain Tax Year 2019 And 2020 Returns Tas

What Is The Penalty For Failure To File Taxes Bankrate

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Know Penalty For Filing Returns After 31 August 2019 And Repercussions