irs rejected return ssn already used

In most cases the taxpayers social security number ssn was entered incorrectly. You entered the wrong SSN on your tax return.

Tax Refund Fraud To Hit 21 Billion And There S Little The Irs Can Do

Owe IRS 10K-110K Back Taxes Check Eligibility.

. Settle up to 95 Less. This morning I received an email stating that my tax return was rejected due to my SSN already being used. Protect your legal and appeal rights.

See if you Qualify for IRS Fresh Start Request Online. Apply For Tax Forgiveness and get help through the process. End Your Tax Nightmare Now.

If someone uses your SSN to. Mail the completed and signed Form 8832 to the appropriate IRS service center which can be determined using the information provided on the IRS Web page Where to File Tax Returns. If a fraudulent return was filed with your SSN Identity theft and tax fraud are two of the most concerning reasons for a rejected tax return.

Owe IRS 10K-110K Back Taxes Check Eligibility. These Tax Relief Companies Can Help. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependents SSN the IRS has security.

You can count on us to. A case of fat fingers digits transposed a small error can result in an. Ad 5 Best Tax Relief Companies of 2022.

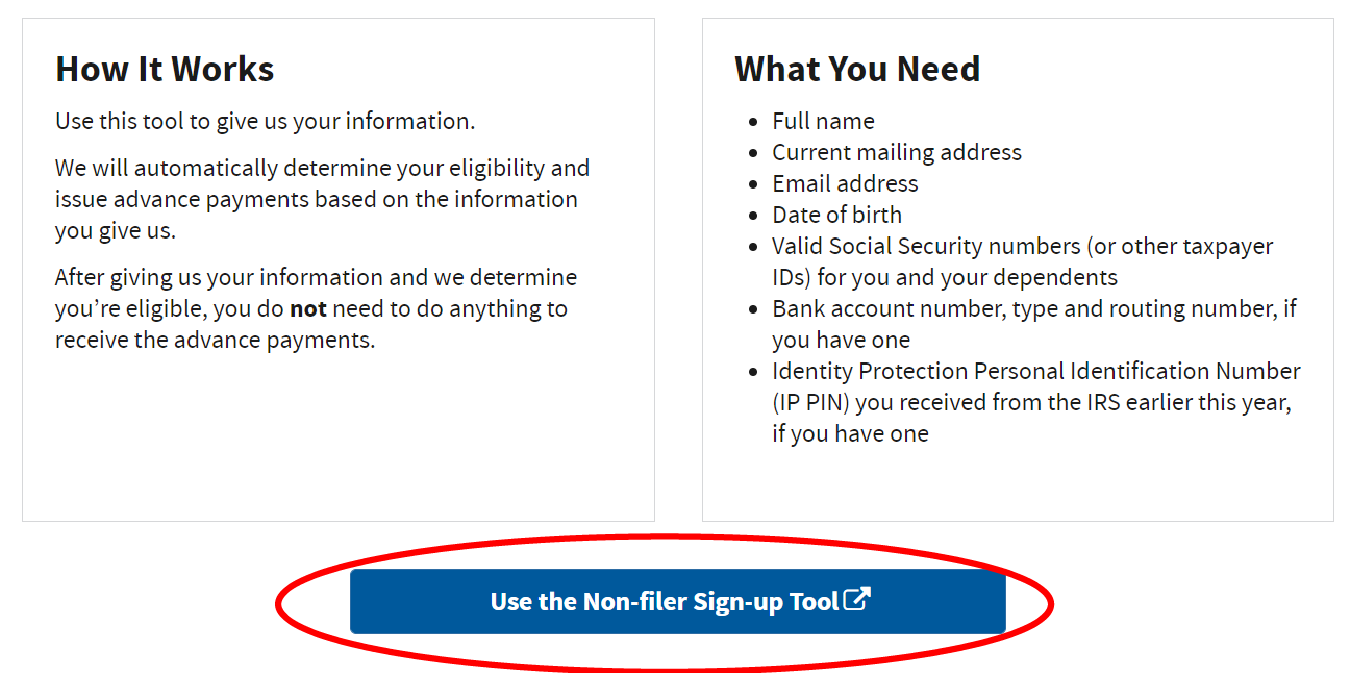

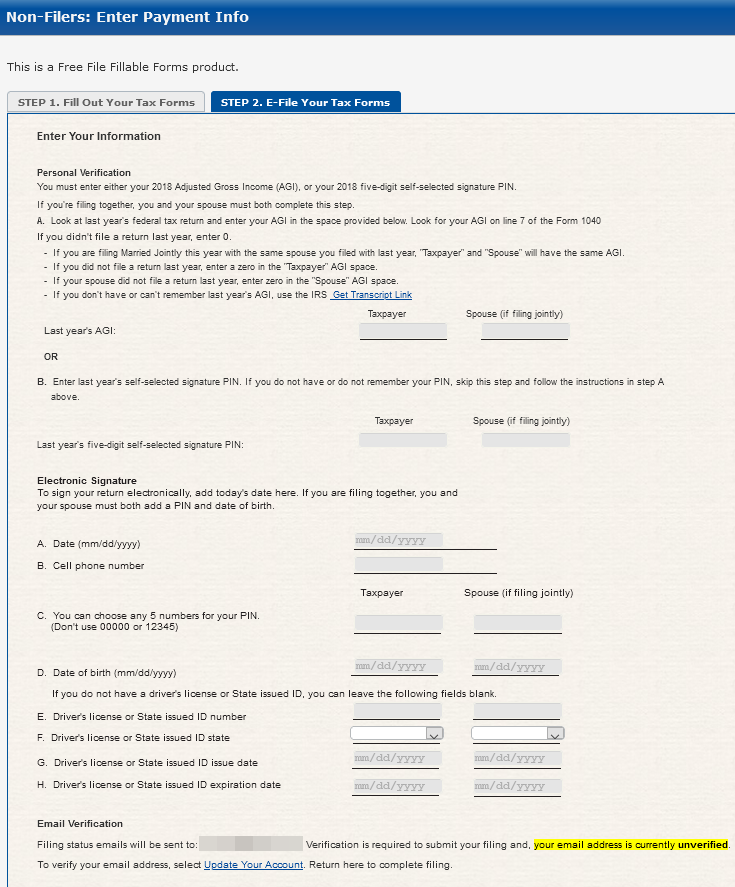

Ad Owe back tax 10K-200K. Get the Help You Need from Top Tax Relief Companies. A few weeks ago I entered my info for a non-filer so I could change my bank.

Irs rejected return ssn already used. The privacy invasion was vast when FBI agents drilled and pried their way into 1400 safe-deposit boxes at the US. See if you Qualify for IRS Fresh Start Request Online.

The IRS ID Theft hot line is 1-800-908-4490. If you mail in your. Ad Owe back tax 10K-200K.

23 2022 5 AM PT. The irs will in some cases contact taxpayers using the. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Ad File Settle Back Taxes. Potential reasons why your SSN has already been used. Whether the cause of this rejection is the result of a typo on another.

If you did not file a Federal return at all this year contact the IRS immediately at 800-829-1040 as an income tax return has been filed using the Primary Taxpayers SSN. To prevent fraudulent returns the IRS only accepts a SSN once in. Some have suggested that heightens the chance of.

Private Vaults store in Beverly Hills. Get Qualification Options for Free. Before you call be aware that IRS will automatically flag your account for review.

Ad You Dont Have to Face the IRS Alone. If your income tax return was selected by the IRS for an examination weve got your back. We deal with the IRS so you dont have to.

Free Quote Consult. Additionally if you think. If my filing of my taxes is rejected because my social security number has already been usedwhat do I do.

Forgot to File Your Taxes. If someone has stolen your Social Security Number and filed a fraudulent tax return to receive your refund your tax filing will be rejected if you try to e-file. Free Evaluation Apply Now.

Trusted Affordable A Rated in BBB. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

How To Fix Your Dependent S Social Security Number Mismatch E File Reject Turbotax Support Video Youtube

12462 Return Status Checking Acknowledgements

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified

Common Irs Where S My Refund Questions And Errors 2022 Update

If Irs Rejects E Filed 2021 Tax Return There S An Unusual Fix

Tax Return Rejection Codes By Irs And State Instructions

How To Fill Out The Irs Non Filer Form Get It Back

Irs Notice Cp01h Identity Theft Lock H R Block

3 Ways To Get A Copy Of Your W 2 From The Irs Wikihow

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Rejected Tax Return Here S What You Should Do

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name Don T Mess With Taxes

How Do I Find Out If My Tax Return Is Accepted E File Com

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

How To Get An Individual Tax Id Number Itin And Why You Need One

10971 Search Reject Codes From The Irs State And Bank

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified